In China, although economic data remains weak, there are early signs of stabilization and gradual recovery. Additionally, the government continues to provide liquidity and support to the market. We expect economic recovery to start in the second quarter.

Elsewhere, as the US will likely avoid a recession and with a rate cut starting this year, the backdrop for Asian equities has become more favourable, given the lower rates and softer US dollar.

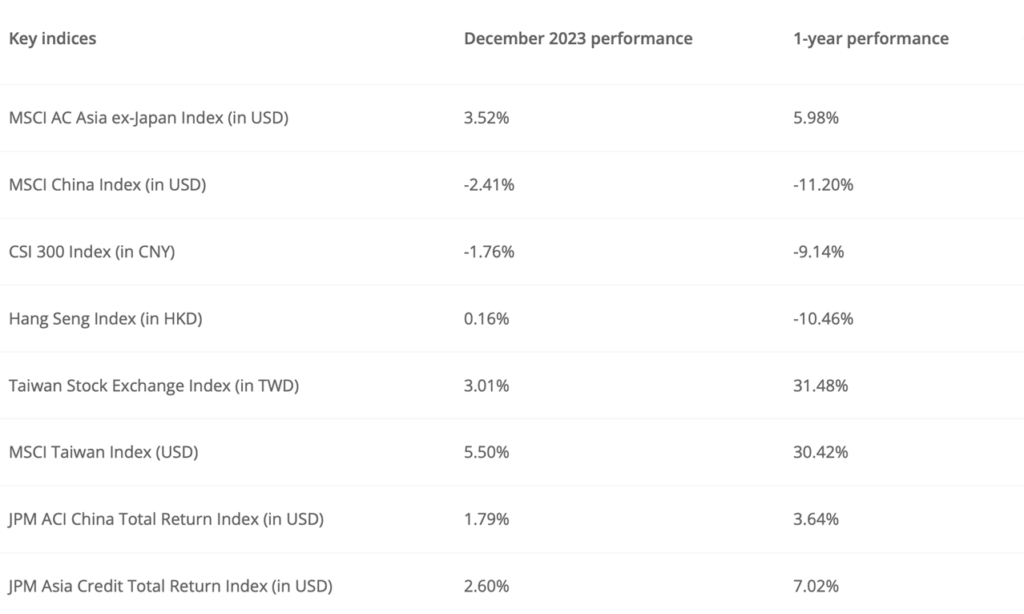

Source: J.P. Morgan, MSCI, Morningstar, Data as of 31 December 2023

China / Hong Kong equities

• The 10-year Treasury yield dropped significantly to below 4% as the market turned very bullish, driven by an aggressive rate cut expectation. The market has now priced in 1.5% of rate cuts in 2024. As this optimistic view of a goldilocks scenario fuelled one of the most aggressive rallies in both US equities and bonds markets in the last nine weeks of 2023, a correction from this overbought situation is unavoidable. Interest rate expectations would be among the most important factors to watch this year.

• In China, although economic data remains weak, there are early signs of stabilization and gradual recovery. The government continues to provide liquidity and support to the market. Our economic model points to an economic recovery starting in the second quarter, given a more favourable comparison base. We expect the market to be bottoming, with some funds starting to reposition for a U-shape rebound this year.

• With lower yields, the liquidity situation in Hong Kong has improved after the year-end. The stabilization of the renminbi also helps Hong Kong-listed Chinese stocks in terms of sentiment.

China A-shares

• The gradual improvement in PMI numbers shows early signs of stabilization and gradual recovery of the economy. However, market sentiment remains weak with low foreign participation.

• Property sales started to stabilize with more policy easing. The stronger renminbi benefited from the weaker US dollar, and the looser financial conditions provided some support to the market. The first quarter of 2024 will likely mark the bottoming of earnings downgrades.

Asia ex-Japan equities

• As the US will likely avoid a recession and with a rate cut starting this year, the backdrop for Asian equities has become more favourable, given the lower rates and softer US dollar. Earnings momentum in ex-China markets continues to be strong.

• India is also on a structural growth cycle, given the country’s strong macro environment and solid domestic consumption.

Emerging market ex-Asia equities

• The lower Treasury yields and the weaker US dollar were also favourable for emerging markets ex-Asia. As developed countries slow down, with interest rate cuts starting later in the year, emerging markets will likely outperform developed markets. However, valuations are also a bit stretched.

Japanese equities

• The expectation of ending the negative interest rate policy and yield curve control in January has disappeared, given the earthquake disaster on New Year’s Day. There will be some short-term relief in equities from the weakening yen.

• However, wage reform continues with more and more companies increasing wages. As wage inflation will likely become a concern, the BOJ will continue to face pressure to adjust its monetary policy. On the other hand, earnings growth remains strong, and corporate governance reforms continue to progress well.

Asia investment grade bonds

• Asia investment grade bonds continued to attract inflows due to their attractive yield levels and negative net issuance. Credit spreads keep tightening as new supply remains tight. However, as the market was overly optimistic about its interest rate cut expectations towards last year’s end, there was some short-term correction in yields as the market needed to adjust its overly dovish expectation.

Asia high yield bonds

• Activities in Asian high yield bonds have become more active as spreads continue to stay above average, and the impacts arising from Chinese property have diminished.

• However, as the market was overly optimistic about its interest rate cut expectation towards last year’s end, there was some short-term correction in yields as the market needed to adjust its overly dovish expectation.

Emerging market debt

• Spreads have become even tighter. However, demand remains strong. With a soft landing backdrop in the US, emerging markets are expected to deliver stronger growth as fundamentals in EM bonds continue to improve.

Gold

• Gold prices have broken their historical high, given strong hopes of rate cuts this year. Although the rally has been relatively excessive – given the still high-interest rates in absolute terms – the positive momentum is also fuelled by some fear of de-dollarization, driven by the Middle East.

• While gold remains a good geopolitical hedge, the recent price surge may also lead to a bigger correction as volatility has increased.

Multi-asset

• A multi-asset strategy offers lower volatility compared to traditional single-asset or balanced portfolios. However, the correlation between risk assets, such as equities, credits, and commodities, has recently increased dramatically. In an uncertain environment with low yields, income becomes an essential source of return for investors.